Disclaimer: While the $30m acquisition number is not yet official, according to the BRAVE tech podcast, the deal was a 3.7x multiple of revenue. For those interested in the numbers, Der Shing’s blog provides an insightful analysis. Here’s an extract.

“TIA was profitable in 2021 with 900k profit on 7m. They did about 7.6m sgd in 2022 and reverted to being loss-making with a loss of about 600k. 2022 subscription weakened and they grew poorer margin production businesses.

It’s also important to note that revenue growth from 2017 to 2022 is barely 6-7% per annum from 5.5 to 7.6m. So TIA has plateaued and is not a growth company any more. So selling is probably a good move. Remember my last post about growth being worth something only if profits are good too? TIA got the memo.. slow down growth but move from very loss-making on 5.5m to nearer profits on 7.6m.”

My thoughts on the TIA deal

The short version: It’s a great deal, though not for the reasons one might immediately think. I’m also gonna rant a bit about SPH Media Trust (SMT), but I feel it’s relevant to this deal, haha.

I consider it a good deal when both parties walk away feeling that they won. TIA having experienced slow growth, has secured a favourable buyout. Meanwhile, SMT’s Business Times audience appears to be well-aligned with TIA’s demographic.

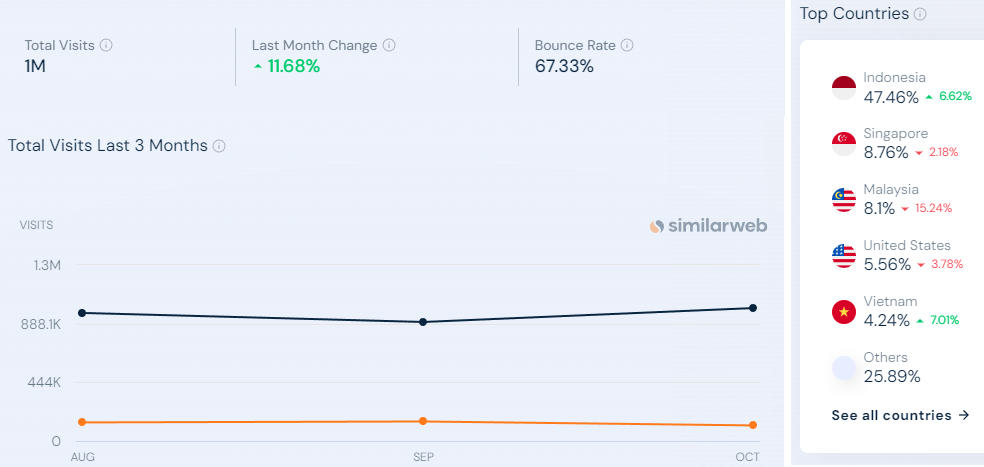

But I don’t believe SMT is getting TIA primarily for their business viewership, as mentioned in their acquisition announcement. The traffic numbers from SimilarWeb aren’t exceptional and there is a significant skew towards Indonesia. According to SimilarWeb, just 10% of their traffic appears to be from Singapore.

While TIA’s demographics may be aligned with SMT’s new regional focus, I’m guessing SMT sees potential in TIA’s robust event infrastructure, which they feel they can supercharge. SMT recently put together the Asia Future Summit 2023, which is a telling example of the possible synergies. They’re positioning these events as a service offering for major clients. It seems logical that SMT would want to bolster this business aspect through their Business Times platform. The case study page mentions:

“Media exposure was further amplified through content pages on The Straits Times, The Business Times, and Lianhe Zaobao. To complement the event, The Straits Times also produced a limited print-run magazine that explored the future of Asia. “

Tech in Asia has two annual flagship events, their Product Development Conference and Tech in Asia Conference. I’m guessing that’s where most of their revenue comes from. Sounds like there are a lot of synergies so it makes sense for them to make these events bigger. This is, of course, all speculative from my external viewpoint.

The $900 million SMT question

But the reason this is an awesome deal is because it reallocates money to the markets more efficiently.

Remember, SPH Media Trust is receiving a whopping $900 million of taxpayer money over 5 years. $30 million is comparatively a small amount. They can do deals like this every year and just be $150m down.

One of SMT’s first initiatives reportedly involved across-the-board salary hikes, a move not necessarily in line with market dynamics. While beneficial for employees in the short term, this approach raises long-term sustainability questions and creates a challenging competitive landscape in the industry for those not privy to such funding.

My reservations about their funding fall into 3 points:

1) Sustainability: In four years, without a fundamental shift towards market-driven operations, SMT is likely poised for another substantial financial infusion. They need to recalibrate to align more closely with market demands. The TIA deal is good because it at least signifies an attempt to be more market-aligned.

2) Market Distortion: This funding has created an uneven playing field, clashing with Singapore’s oft-praised meritocratic values. These organisations often release products without the usual constraints imposed by profit and loss concerns, leading to a lack of market-fit accountability.

I kid you not, I’ve spoken to some of the directors at these legacy companies who have surprising indifference to the P&L of their initiatives, reflecting a broader organisational attitude towards the market fit of their products.

3) Industry Decline: This lack of market alignment leads to developing products that continuously miss the mark, undermining the critical role of P&L in guiding business decisions. Like the time they ill-advisedly tried to create their own search engine to compete with Google, called Rednano back in 2009. Millions have gone down the drain, now scrubbed from their history.

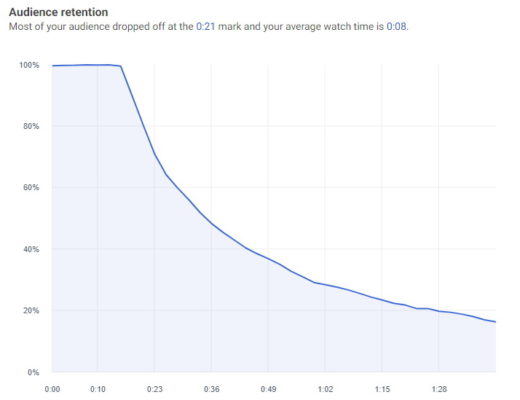

The final consequence of the lack of market fit is being felt by Singaporeans, as our media industry struggles to stay relevant amidst other advancing industries around the world. Singaporeans don’t trust/read certain outlets which heavy funding goes into, and we don’t watch content that is locally produced.

Our broadcasting and film industry (controlled by Mediacorp) isn’t able to be globally competitive, beyond the few mentions at film festivals every year thanks to the indie filmmakers who risk everything to push their craft. It’s the Colin-Joseph Schooling story again. The outliers succeed despite the system, not because of it.

That responsibility should not fall onto our outliers, especially when the government has already set aside resources with the best intentions – they are just not being allocated correctly. It pains me as a Singaporean who wants to see our industry do well. But we can never be globally competitive if resources keep being channelled into legacy organisations that don’t have the right business model / fit for the market.

In summary:

Current situation:

Wrong market fit > stubbornly continue, use unsustainable cash injections > market distortion > industry decline.

What I’d like to see:

Wrong market fit > use of cash injections to acquire / fix things to get market fit > fair market > industry growth.

Why the TechInAsia acquisition is a great first step

This deal might change things. In a very roundabout way, deals like this may redirect funds towards new, perhaps more deserving avenues, ensuring that taxpayer money is utilised more judiciously.

I hope to see the further redistribution of such funds within the industry, hopefully through a proper fund established and not through SPH/Mediacorp as it is now. But otherwise, even if the resources have to first flow into legacy organisations before being channelled to companies with market fit (profitable companies), it’s at least a step towards being more market-aligned.

It’s not just publishers who should benefit, but a whole range of companies in the media industry. From production houses to creative agencies to developing the infrastructure to support individual content creators – this video below could be a reality with the right support. Many other markets are already far ahead of us.

There’s a burgeoning ecosystem that, with proper investment, could experience a surge, all sustainable and aligned with market forces. Ultimately, this would enhance the quality of media consumed by Singaporeans.

While the TIA-SPH deal is significant, its real impact might just be being the catalyst for a much-needed industry transformation, if it paves the way for similar reallocation of funds to follow suit.

Comments